Dealing with Covid-19 Debt

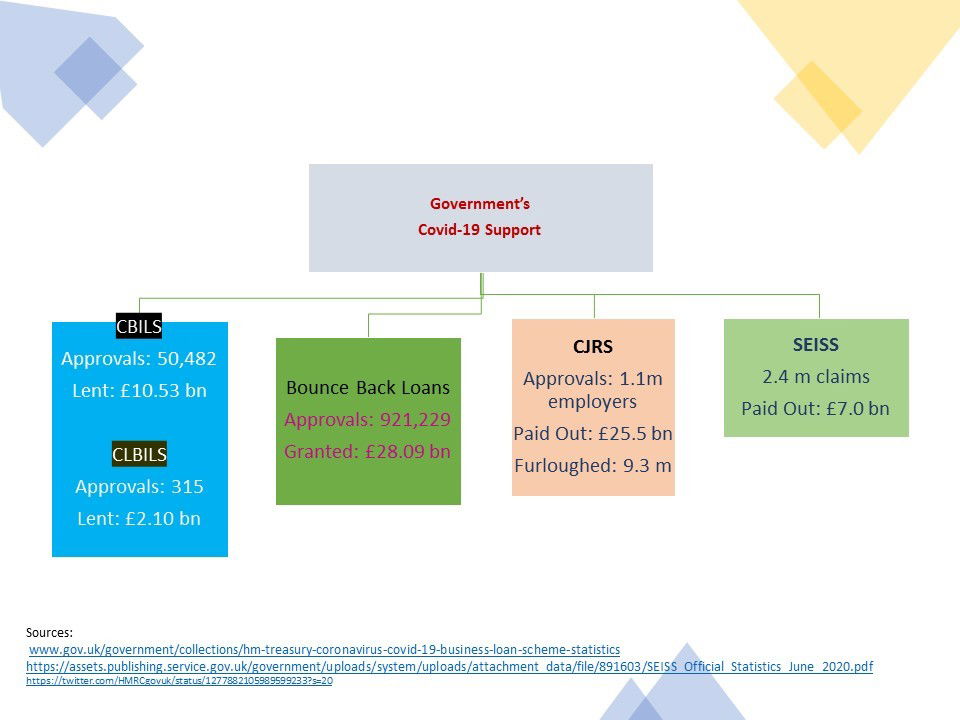

The amount of money being lent to businesses by the Government during the Covid-19 pandemic is astronomic. While the gathering corporate debt mountain is seen as essential to keep businesses afloat, there's growing concern about how it is going to be paid back, especially by SMEs, who have taken more than £50bn of loans*.

The Government's guarantee backing of loans is given to lenders not to borrowers, so their managements do need to plan ahead to meet these loan liabilities.

Before lenders can call on the taxpayer's guarantee, they are required to try to recover the loans themselves. It's reasonable to believe that both lenders and Government don't want to see businesses pushed to default and potentially into insolvency, due to their debt burden.

Before lenders can call on the taxpayer's guarantee, they are required to try to recover the loans themselves. It's reasonable to believe that both lenders and Government don't want to see businesses pushed to default and potentially into insolvency, due to their debt burden.

What are the options open to avoid such an outcome?

The CityUK (the industry-led body representing UK-based financial and related professional services) has been leading the research into alternatives to debt repayment. Its Recapitalisation Group has consulted with a range of stakeholders, including the Bank of England (that's printing much of the money for the loans) and a range of business groups like the CBI, and British Chambers of Commerce.

A number of options are still being considered for roll-out, with the aim of relieving businesses from having to find the cash to make repayments when they are struggling to earn what they were before lockdown.

The options:

A wide range of ideas for recapitalisation instruments are currently under development by CityUK, with each instrument being developed with a draft term sheet that will govern its application, terms and exit. The range of instruments are grouped into:

Debt recapitalisation instruments

– Preferred equity – sitting ahead of ordinary shares but still treated as equity.

– Contingent Tax Liability (CTL) – conversion of stimulus debt to a tax that would be payable out of profits and collected through the tax system.

– Profit participating debt – an alternative to the CTL that links repayment to the generation of profits.

– Forbearance – the simplified application of debt moratoria and rescheduling.

– Debt forgiveness/grants – perhaps applicable in extreme distress.

Growth instruments

– Common equity – the provision of ordinary shares.

– Preferred equity – the provision of preferred stock with defined term and dividend payment obligations.

Further details of how these types of instrument could work are contained in CityUK's Interim Report

There is a question of how the scheme options will be triggered and paid for.

* CityUK's Interim Report- Extract3.3 SMEs are estimated to incur around half of total unsustainable lending, amounting to circa £50-56bn • The UK has a total business population of circa 5.9 million (as of 2019) of which the vast majority (circa 99%) comprises of SMEs defined as businesses with up to 249 employees. • SMEs comprise circa 52% of UK turnover (as of 2019) and circa 60% of UK employment (as of 2019), larger businesses, defined as those with 250 employees and above account for circa 48% of UK turnover and circa 40% of UK employment. • We estimate the amount of unsustainable lending volumes to be fairly evenly split between SMEs and large businesses, with SMEs accounting for circa £50-56bn in potential unsustainable lending volumes and large businesses circa £47-51bn. • ONS surveys on the business impact from Covid-19 indicate that circa 30% of SMEs are either unsure or not confident with regard to the sufficiency of their financial resources to continue operating throughout the coronavirus outbreak. For larger businesses,circa 23% of respondents responded similarly. • Further surveys of SMEs (BBRS) indicate that c.45% of respondents who have taken out a loan from a government business lending scheme may not repay them. • The UK’s business community also includes a population of circa 1.6k listed entities; these businesses typically have greater options for financing than SMEs.

By the publications team at: Contracts-Direct.com

Publisher: Atkins-Shield Ltd: Company No. 11638521

Registered Office: 71-75, Shelton Street, Covent Garden, London, WC2H 9JQ

Note: This publication does not necessarily deal with every important topic nor cover every aspect of the topics with which it deals. It is not designed to provide legal or other advice. The information contained in this document is intended to be for informational purposes and general interest only.

E&OE

Atkins-Shield Ltd © 2020